Introduction

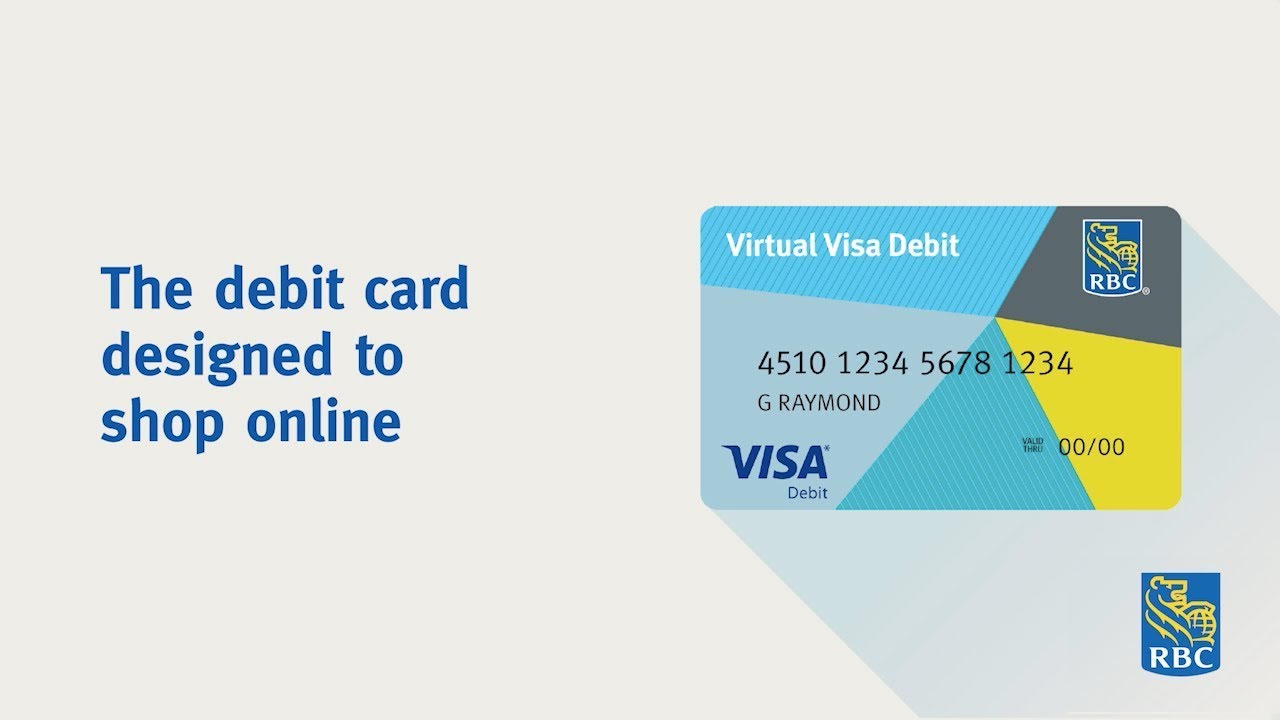

I have a virtual Visa card, but I can’t use it for online shopping. Is there anything I can do?

Yes, you’re able to use your virtual Visa card for a variety of purchases. However, you’ll want to make sure that the merchant accepts these cards before you click “Buy Now.” Each merchant has its own policies and procedures when it comes to accepting virtual cards. So how do you know what these terms are? Well, each merchant’s website will give you some information about their policy on accepting your card (or debit card). You’ll find this information at the bottom right hand corner where it says “Privacy Policy” or something similar.

Choose your card type.

There are two types of virtual Visa cards: a physical card that you can use at any merchant, and an e-Visa card that’s linked to your existing financial accounts. Starting by learning about how to use a virtual visa card can prove quite useful. If you have an existing account, then choose the e-Visa option; otherwise, select the physical option.

Once it’s determined which type of virtual Visa card will work best for your needs and budget (assuming there are no other restrictions), choose between a variety of options based on what kind of information is required for verification purposes. For example, some cards require phone verification while others do not–so be sure to check before completing setup!

Select a Payment Method.

Now, you’ll need to select a payment method. The most popular options are credit cards and debit cards. If you select a debit card, it will be automatically charged when you make purchases on the site and withdrawals from ATM machines (if they support this feature). However, if there is no PIN associated with your account or if someone tries to withdraw money from an ATM that doesn’t support pin entry and identification (like most Western Union locations), then all funds will be lost!

If choosing between using either type of card or both at once makes sense for whatever reason–for example, if one person in your party has an account with Bank of America while another has one with Chase–then go ahead and use both kinds together; however keep in mind that each transaction usually comes out at either $1 per transaction or $2 USD per purchase depending on which bank was used first before making any other purchases later on down the road during checkout process itself.”

Enter the amount you want to spend.

- Enter the amount you want to spend, and then click “Pay.”

- If you’re using your virtual card for a transaction that will take several days or weeks to complete, enter your credit card in advance. The money will be available on your account when it’s completed.

Check out and make the payment.

You can now pay with your virtual Visa card. Simply click on the “Payment” button, and then select “Make a payment.”

The next screen will display your virtual Visa card number, account name, and expiry date. If you already have an account set up in the system, this information should already be filled out for you. Otherwise follow these steps:

- Select your desired payment method – either bank transfer or credit/debit card (by tapping on one of those options).

- Enter in any additional details about how much money is owed (e.g., total amount charged) and who owes it this time around instead of last time around if applicable because sometimes things change between when we run into problems at home while traveling abroad where I’m staying with friends who live overseas too!

You can use your virtual Visa card in an online store to pay for goods or services.

The enhanced security of the virtual Visa payment method ensures that only you, the cardholder, will be able to make purchases on an e-commerce website. When you are shopping at an online store with a virtual Visa card, there is no need to worry about someone else accessing your personal data or making unauthorized transactions on your behalf.

Conclusion

Don’t worry about the security of your virtual Visa card. There are many websites that allow you to use this type of credit card for online shopping. However, there are some things that you should keep in mind when using them including:

- The sites where you can use them are provided by banks and credit unions that have been approved by Visa or MasterCard. So, before choosing one of these sites, make sure it is authorized by the two major payment networks.

- Always check the terms and conditions for any fees or interest rates associated with using a virtual debit card online. If there are extra fees related to using these services then make sure they will not affect your budgeting or spending habits too much as well!